28+ deduct interest on mortgage

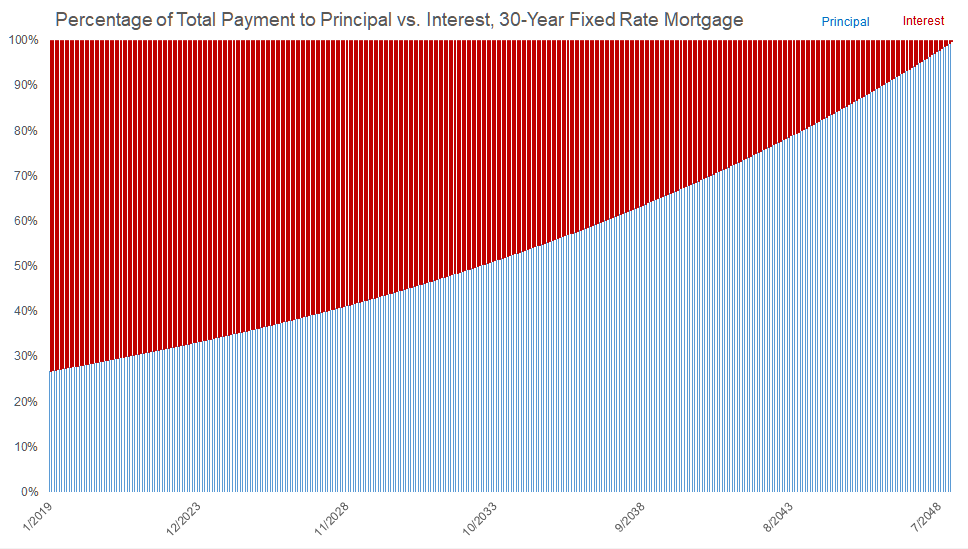

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. 1 2018 youre allowed to deduct the interest paid on up to 1 million of home acquisition debt plus 100000 of home.

Young And High Net Worth What S Next Bogleheads Org

Find Your Best Offers.

. Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Homeowners who are married but filing.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. With the passing of the TCJA. Web As long as youve completed the purchase by April 1 2018 the mortgage interest deduction limit is 1 million instead of 750000.

Ad Lock In a Low Interest Rate for Your 2nd Mortgage Loan. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Web Home mortgage interest.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Web Taxpayers who took out a mortgage after Dec.

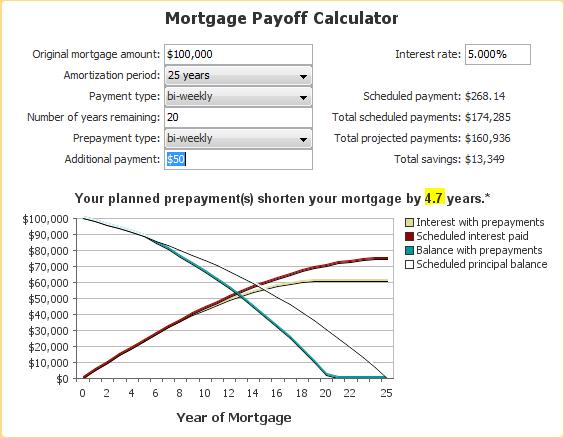

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web HB 3010 limits Oregonians mortgage interest deduction from January 1 2024 to January 1 2028. Ad Shortening your term could save you money over the life of your loan.

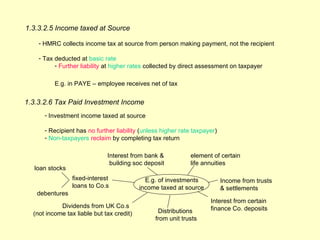

Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. Web The deduction for mortgage interest is available to taxpayers who choose to itemize. However higher limitations 1.

15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The mortgage interest deduction allows homeowners who itemize their deductions on their tax forms to deduct their interest on qualified personal residence.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web If you took out your mortgage before Jan. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

Web Most homeowners can deduct all of their mortgage interest. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Make an Informed Decision. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Under the bill fifty percent of the estimated revenue increase. Explore 2nd Mortgage Loan Rates from Top-Rated Lenders.

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Tax Deduction What You Need To Know

Unity Credit Union Mortgage Disclosure

Business Succession Planning And Exit Strategies For The Closely Held

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction How It Calculate Tax Savings

Home Loan Does Paying A Mortgage Early Mean You Effectively Paid A Much Higher Interest Rate Personal Finance Money Stack Exchange

Mortgage Interest Deduction Bankrate

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Cemap 1 Final Copy

What S The Return On Mortgage Prepayments

Keep The Mortgage For The Home Mortgage Interest Deduction

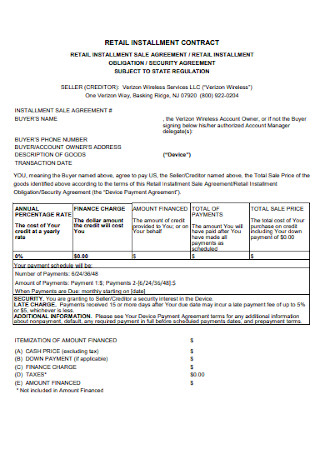

28 Sample Installment Contract Templates In Pdf Ms Word

How To Get The Lowest Mortgage Interest Rate Possible

May 2010 Association Of Dutch Businessmen

Mortgage Interest Deduction A 2022 Guide Credible